IRS Form W-4 is one that most people will fill out when employed and earning income. The form, titled “Employee’s Withholding Certificate,” is a way for the Internal Revenue Service (IRS) to tell employers how much tax to withhold from an employee’s paycheck. Employers will have employees fill out this form when they are first hired, and it then tells them how much money to take from the employee’s gross earnings to pay to the IRS directly.

Filling Out Form W-4

To fill out this form, consider the following steps:

- Enter Personal Information: This includes your name, Social Security number, address, and filing status. Your filing status could be single, married filing jointly, or others.

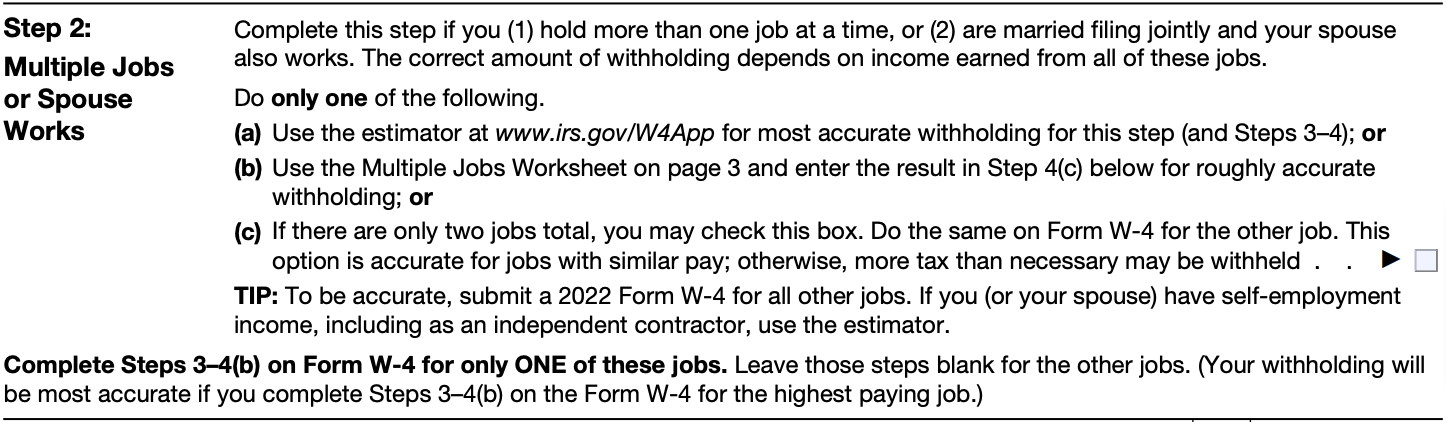

- Account for jobs: If you have more than one job or you are filing jointly with your spouse, you will need to account for that in this next section. For example, when completing this form for your highest-paid job, fill out steps 2 through 4, but don’t do the rest. If you and your spouse are filing jointly, check the box here to indicate that.

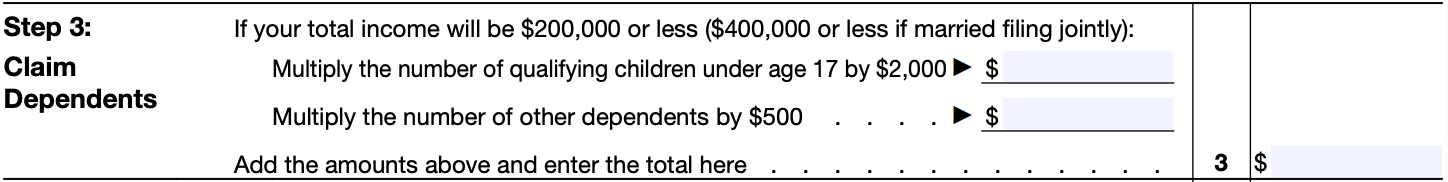

- Claim Dependents: This includes children that are living in your home or others who are your legal dependents. If you earn under $200,000 alone or $400,000 when filing jointly, enter this number and multiply it by the credit amount on the form.

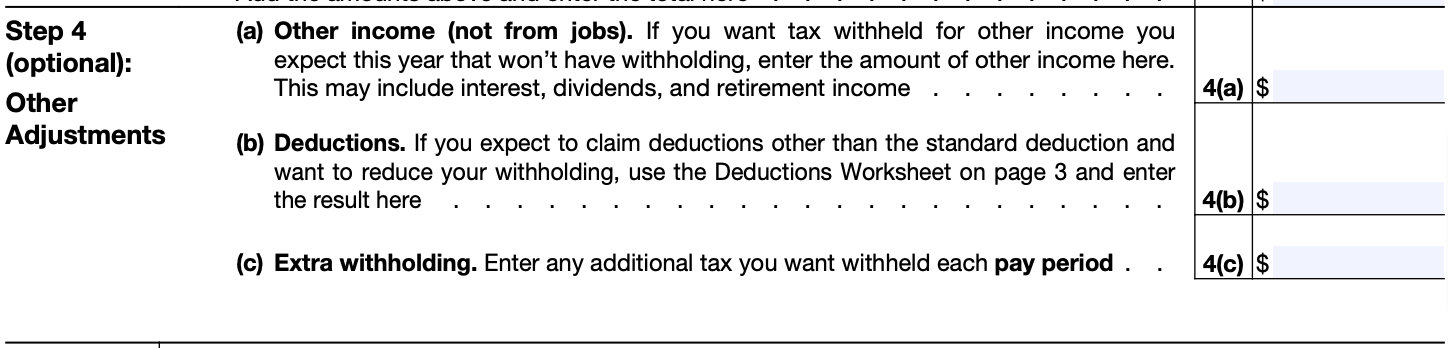

- Other Adjustments: In this step, you can decide if you want the government to take out extra from your taxes. You can also note that you expect to receive deductions and may be paying less.

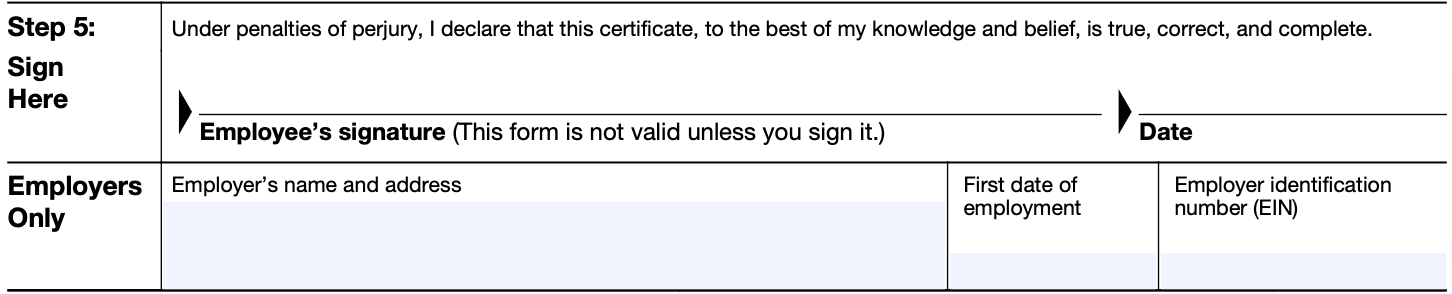

- Sign your W-4: You then need to sign and date the W-4. It also has to be completed by your employer.

Increasing or Decreasing Withholding

From time to time during your period of employment, you might find yourself needing to make adjustments to your withholding. For instance, you owed a significant amount of money to the IRS last year when you filed your return. When this happens, it often means that you did not pay enough into the tax system through withholding. That could be a problem because you may be responsible for additional fines and fees. The IRS expects you to pay taxes during the year on at least 90% of the money you’ll receive.

One way to avoid this is by having the employer take out more than what your standard withholding could be. That way, you pay slightly more each paycheck into the system and are less likely to have a significant debt next year. In this case, increasing your withholding is a good idea.

You may want to decrease your withholding in some situations. For example, if you receive a substantial refund each year, you are overpaying into the system, and that’s money you could have during the year. You may also want to reduce your withholding if you feel you will qualify for deductions beyond the standard deduction, which could reduce the money owed to the IRS. In this case, you can request to have the employer take out less than you are paying now.

When to Update Form W-4

The IRS will update the W-4 form from time to time. If you have been with your employer for a long time, you may want to have this information updated. Though the information is not necessarily different, some information may make it clear which is the best decision for your needs.

You should update your W-4 in various cases. Here are some examples:

- Your dependents have changed.

- Your tax filing status has changed.

- You owed money last year.

- You bought a house.

- You took a significant paycheck.

- You started freelancing.

- You received a huge refund last year.

You have the right to change your withholdings for any reason that makes sense to you. You are so able to do this whenever you wish to do so.

Other Considerations

You can work to tweak your withholdings throughout the year as you see your income change. For example, if your spouse gets a new job that pays much more, you may want to update your withholdings to reduce what is being taken out since they’ll be paying more. The more accurate the form is when your employer receives it, the more likely you will not owe taxes for the year. That’s important since most people don’t want a hefty tax bill.