Reporting your income to the Internal Revenue Service (IRS) is a necessary step in the U.S. It is up to you to document all of your income to the IRS at tax time. However, your employer is also responsible for providing this information to the IRS. Here’s what you need to know.

Overview of Income Reporting

Income reporting is the process of informing the IRS of your earnings. Whether you are an employee or a self-employed individual, or both, it is necessary to report your income to the IRS on an annual basis. How that happens depends on a few key things, primarily how you work.

The W-2 Wage and Tax Statement

Most people work for an employer. The employer must report how much they are paying you to the IRS. They not only document that information, but employers typically collect income tax from your paycheck before you receive it, called income tax withholding. They then send those taxes to the IRS periodically during the year.

Your employer must submit a W-2 to the IRS at the end of the year. This document, called the Wage and Tax Statement, tells the IRS what your annual wages were and the amount of money the employer withheld from your paycheck and paid to the IRS on your behalf.

An employer must send a W-2 to the IRS for every employee who was paid wages, a salary or earned income in any other way. This includes only direct employees and not self-employed workers or contracted workers. The W-2 must be submitted to the IRS each year by January 31st. A copy of the form is also sent to you. You will need to use this form later to complete your income taxes (typically due on April 15th for the previous year).

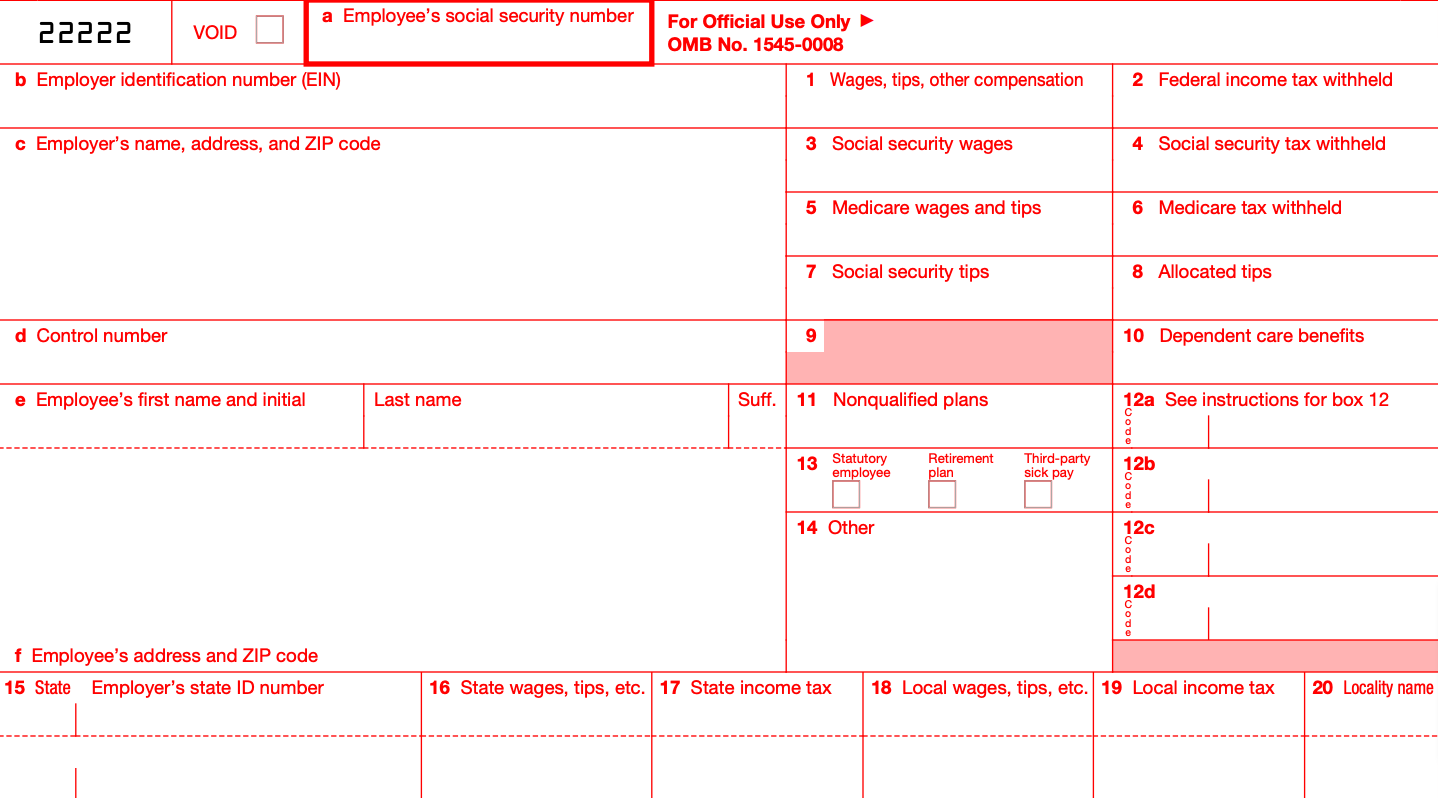

Reading a Form W-2

When you receive a Form W-2, you’ll see a lot of boxes and numbers on the form. Let’s break down what goes in each box and what the details mean. Look for the small letters in the box to identify each spot.

Boxes A through F

These fields will contain the name and address of you and your employer. There is also a place for your Social Security number and your employer’s EIN, which is like a business Social Security number. A state ID is also listed.

Box 1

In this box, you will see your taxable income or income expected to be taxed. This could include your salary, wages, any tips you were paid, bonuses, and other compensation.

Box 2

This box represents the amount of money the employer withheld from your pay and sent to the IRS for federal income taxes.

Box 3

This box is for Social Security Tax, showing how much of your earnings are subject to this tax.

Box 4

This box is the amount of money that the employer withheld from your paycheck to pay Social Security taxes for you.

Box 5

This is the amount of earnings subject to Medicare tax.

Box 6

This is the amount the employer withheld from your paycheck for Medicare taxes.

Box 7 and 8

These boxes are for tips. If you were paid tips, Box 7 is where you will see how much you reported, while Box 8 shows how much your employer reported in tips.

Box 9

This should be empty.

Box 10

This box will include the amount your employer provided for dependent care benefits. This would be empty if you did not receive those benefits.

Box 11

This amount relates to the deferred compensation you received from your employer. This could be blank if you did not receive those funds.

Box 12

This could include contributions to your 401(k) or other types of compensation or reductions you are reporting that could reduce what you owe.

Box 13

This area is where any pay not subject to federal income tax withholding is listed. This could be an employer-sponsored retirement plan or sick pay you received.

Box 14

In this section, you will report any type of additional information that does not correlate to the previously listed areas.

Boxes 15 through 20

All state and local tax information is documented in these boxes. For example, it includes how much was paid to your state or local taxing authority throughout the year.

The 1099 Form

The 1099 tax form is designed for those who earn income not reported by an employer, such as self-employed people. You must report your income if you do contract work, freelance work, or have 10 different side hustles. If any organization pays you any amount over $600, they are required to send you a 1099 (or the below appropriate forms) to report that income to the IRS.

Types of 1099 Forms

There are several types of 1099 forms:

- A 1099-NEC is for those who are reporting non-employee income, such as become you are self-employed.

- A 1099-INT reports interest income, such as the interest earned on your savings or investment accounts.

- A 1099-DIV is a form used to report dividend income from your investment accounts.

- A 1099-MISC is used to report miscellaneous types of income, such as money you earned as a prize.

- The 1099-S is used to report real estate transactions that closed in which they realized gains from the transaction.

- A 1099-B is used for transactions from a brokerage, such as when you sell stocks.

Reporting Self-Employment Income

It is necessary to report any income you receive. Self-employment tax is also required to calculate and document, and that’s done on Schedule SE (Form 1040) as Self Employment Tax. You need to complete Schedule C, in most cases, which is called Profit or Loss from Business. If you are a farmer, you must complete Schedule F: Farmers. If you are within these organizations, you may be required to complete Schedule K-1: Partnerships of Multi-Member LLCs.

Reporting your income is a must in the U.S. Using the most appropriate method for doing so is essential to ensure you are reporting your income accurately so proper taxation is applied.